How to Reduce Tariffs: A Strategic Guide

With shifting trade policies and rising import costs, brands that rely on international sourcing must think ahead. Instead of reacting to tariff changes as they happen, businesses need a strategic approach to minimize costs and protect margins.

In this guide, we cover three key strategies to navigate the complex tariff landscape, reduce duty expenses, and optimize your supply chain.

1. Leverage Foreign Trade Zones to Maximize Cash Flow

Foreign Trade Zones (FTZs) allow businesses to store imported goods without paying duties until they enter the U.S. market. This deferral can provide significant financial benefits, especially for direct to consumer brands.

Why Foreign Trade Zones Matter

Defer tariff payments – Duties are only paid when products leave the FTZ for distribution.

Align costs with revenue – You pay tariffs at the time of sale rather than at the time of import.

Improve cash flow – Retain working capital longer instead of tying it up in duties.

Example: How an FTZ Saves Money

Imagine an apparel brand that imports thousands of denim jackets. Instead of paying tariffs when the goods arrive at port, the brand stores them in an FTZ. When a customer makes a purchase, the duty is paid at checkout rather than upfront. This can mean months of additional cash flow, which can be reinvested in marketing or inventory growth.

📌 Learn more: U.S. Customs and Border Protection’s guide to Foreign Trade Zones

2. Optimize Supplier Networks to Reduce Duty Costs

Not all countries are taxed the same, even for identical products. The country of origin plays a critical role in determining tariff rates. Brands that fail to optimize their supplier networks could be overpaying thousands in unnecessary duties.

What Brands Should Do

✔ Run tariff simulations – Before exploring new suppliers, Importal’s Duty Calculator helps brands analyze duty and tax savings across global sourcing options, ensuring they retain every possible dollar. For example, importing golf clubs from Japan instead of China would reduce duties by 21.9%.

✔ Reevaluate supplier options – If sourcing from a high tariff country, consider alternatives with lower duty rates. Companies like SourceReady provide data coverage in over 30 countries, including numerous duty-free regions, helping brands diversify their supply chains and minimize tariff exposure.

📌 Best countries for duty free sourcing: Check out all free trade agreements here

3. Centralize Customs Brokerage for a Single Source of Truth

Many companies work with multiple customs brokers across different lanes or regions. While this might seem like a good strategy, it often leads to inconsistent filings, classification errors, and missed cost-saving opportunities.

Why a Single Brokerage Partner Matters

Faster tariff updates – A dedicated brokerage partner tracks trade policies in real time, ensuring you stay ahead of regulatory changes.

Better compliance – Multiple brokers increase the risk of misclassification and unnecessary duty payments.

Enhanced visibility – A single customs partner provides centralized reporting on duty spend, tariff deadlines, and exemption opportunities.

Example: How Consolidation Saves Money

A brand that relies on multiple brokers may find that none are truly invested in understanding their products at a deep level. Without this intimacy, brokers may overlook classification nuances or fail to identify tariff exemptions and reclassifications that could significantly reduce costs.

With a single, highly capable brokerage partner, brands can be confident that every duty mitigation strategy is uncovered and applied effectively.

How to Choose the Right Customs Brokerage Partner

✔ Technology driven tracking – Find an AI powered broker to guarantee accuracy and compliance.

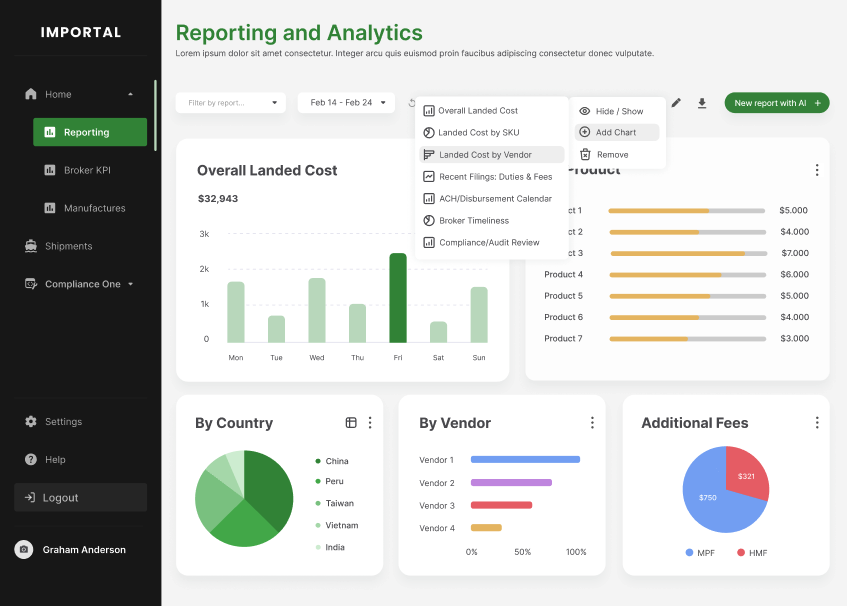

✔ Centralized customs dashboard – Gain full visibility into filings, payments, and tariff updates.

✔ Automated compliance monitoring – Reduce manual tracking of trade policy shifts.

📌 Need a better customs broker? Check out Importal’s customs broker solutions